| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | | | |

NOTICE OF SPECIALANNUAL MEETING OF STOCKHOLDERS OCTOBER 12, 2023MAY 23, 2024

A special

The 2024 annual meeting of stockholders (the “Special Meeting”) of AquaBounty Technologies, Inc. (“we,” “our,“us,” “AquaBounty” or the “Company”) will be held on October 12, 2023,May 23, 2024, at 8:30 a.m., Eastern Time, at 2 Mill & Main Place,233 Ayer Road, Suite 395, Maynard,4, Harvard, MA 01754,01451, for the following purposes: To approve an amendment to our Third Amended and Restated Certificate of Incorporation, as amended, to approve a reverse stock split (the “Reverse Stock Split”) of our common stock, par value $0.001 per share (“Common Stock”), and an associated reduction in the number of shares of Common Stock we are authorized to issue (the “Authorized Capital Change”), from 150,000,000 to 75,000,000 (the “Reverse Stock Split Proposal”

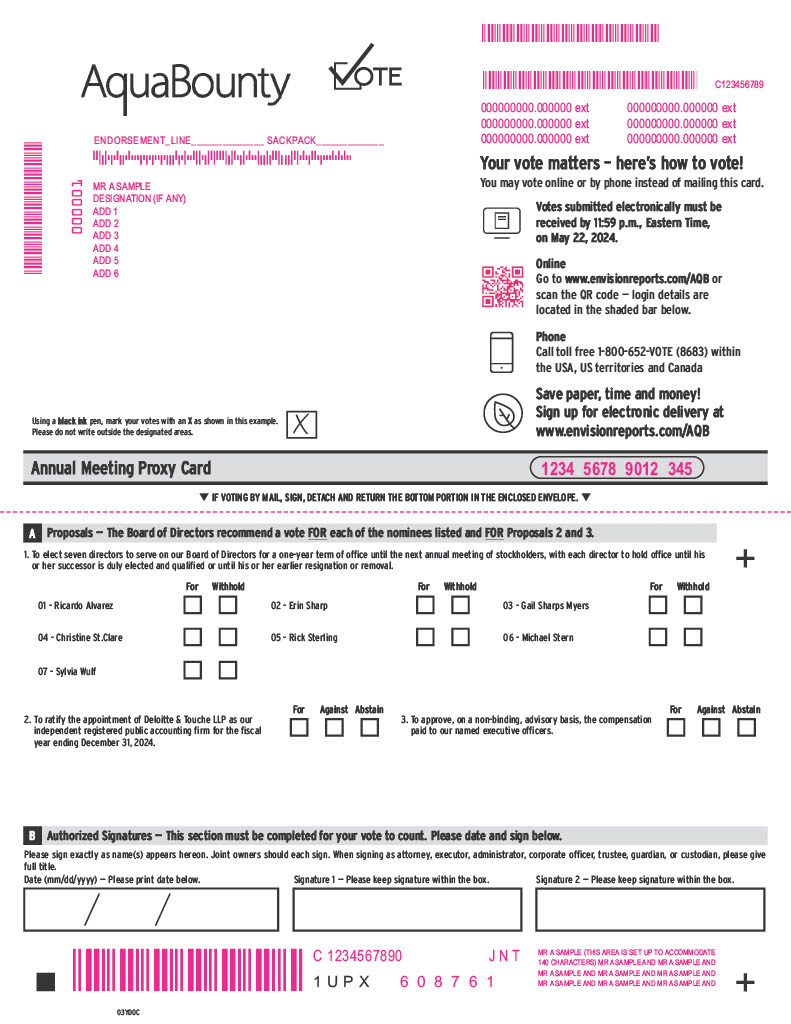

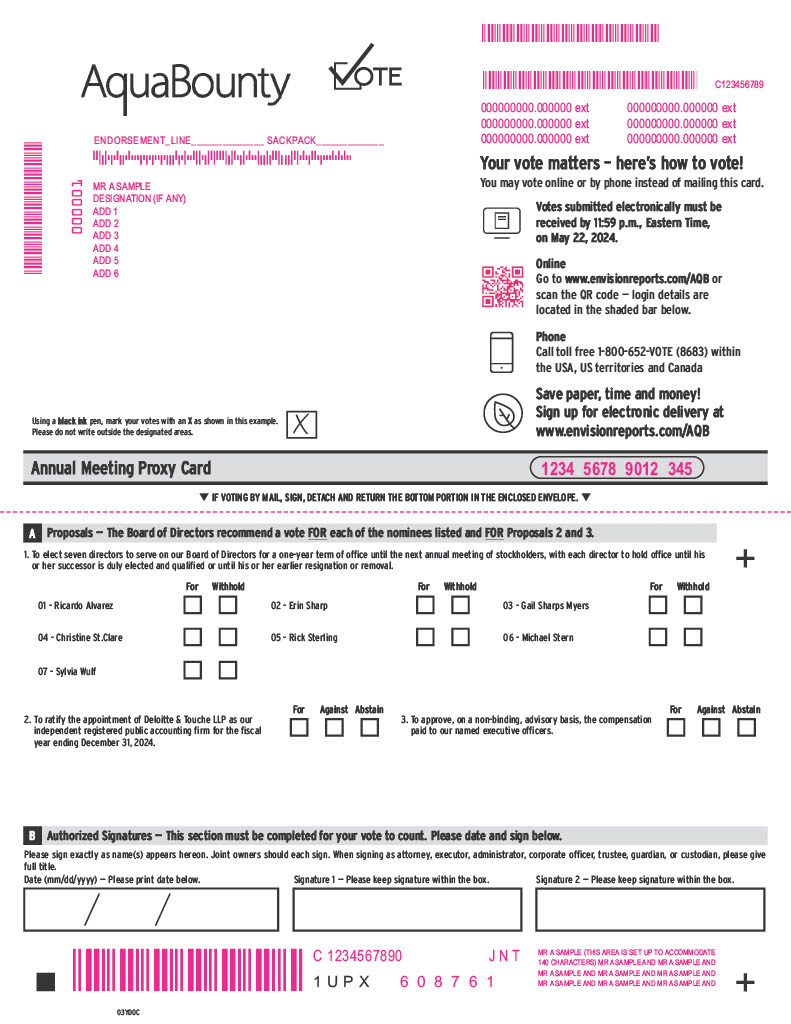

| · | | to elect seven directors to serve on our Board of Directors (our “Board”) for a one-year term of office until the next annual meeting of stockholders, with each director to hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal (“Proposal 1”); |

| · | | to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (“Proposal 2”); |

| · | | to approve, on a non-binding, advisory basis, the compensation paid to our named executive officers (“Proposal 3”); and |

| · | | to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Reverse Stock Split Proposal (the “Adjournment Proposal”).

After careful consideration, the board of directors of the Companyour Board recommends a vote “FOR” the Reverse Stock Splitelection of each of the director nominees listed in Proposal 1 and a vote “FOR” the Adjournment Proposal.Proposals 2 and 3. Only stockholders of record at the close of business on August 21, 2023,March 25, 2024, the record date, are entitled to notice of and to vote at the Special Meetingannual meeting or at any postponement(s) or adjournment(s) thereof. A complete list of the stockholders of the Company entitled to vote at the Special Meeting will be open to the examination of any stockholder during ordinary business hours for a period of ten days prior to the Special Meeting for any purpose germane to the meeting at the Company’s principal place of business at 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754. Your vote is very important. Whether or not you plan to attend the Special Meeting,annual meeting, we hope you will vote as soon as possible. Please vote before the Special Meetingannual meeting using the Internet, telephone,Internet; telephone; or by signing, dating, and mailing the proxy card in the pre-paid envelope, to ensure that your vote will be counted. Please review the instructions on each of your voting options described in the accompanying proxy statement. Your proxy may be revoked before the vote at the Special Meetingannual meeting by following the procedures outlined in the accompanying proxy statement. | | | | | Sincerely, | | | | | | Sylvia Wulf | | | Chief Executive Officer and Board Chair | | | | Harvard, Massachusetts | | | | | | April 5, 2024 | | |

Sylvia Wulf

President, Chief Executive Officer, and Board Chair

Maynard, Massachusetts

[●], 2023

Forward-Looking Statements This proxy statement contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, as amended, that involve significant risks and uncertainties about AquaBounty. All statements other than statements of historical fact are forward-looking statements and AquaBounty may use words such as “expect,” “anticipate,” “project,” “intend,” “plan,” “aim,” “believe,” “seek,” “estimate,” “can,” “focus,” “will,” and “may,” similar expressions and the negative forms of such expressions to identify such forward-looking statements. We have based these forward-looking statements on our current expectations, assumptions, estimates, and projections. While we believe these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks, uncertainties, and other factors, many of which are outside of our control, which could cause our actual results, performance, or achievements to differ materially from any results, performance, or achievements expressed or implied by such forward-looking statements. These statementsrisks and uncertainties include, but are not limited to,to: our expectations regardinghistory of net losses and the market pricelikelihood of our Common Stock, our ability to regain and maintain compliance with the continued listing standards of the Nasdaq Capital Market, risks and benefits of approving or not approving the Reverse Stock Split Proposal, including with respect to making our Common Stock more attractive to a broader range of institutional and other investors, facilitating higher levels of institutional stock ownership and better enabling us to raise funds to help finance operations, our expectations regarding our actions to try to meet the Nasdaq Capital Market’s initial listing standards and submitting an application for our Common Stock to be listed on the Nasdaq Capital Market, our ability to meet our obligations under outstanding options and restricted stock units and our expectations regarding utilizing the relative increase in our authorized shares as a result of the Authorized Capital Change and Reverse Stock Split to raise additional capital, including with respect to financing the development and construction of additional farms, including the Ohio farm. Among the important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are risks relating to, among other things,future net losses; our ability to continue as a going concern; the potential for delays and increased costs relatedour ability to construction ofraise substantial additional capital on acceptable terms, or at all, which is required to implement our new farms and renovations to existing farms; a failurebusiness strategy as planned, or at all; our ability to raise additional capitalfunds in sufficient amounts on a timely basis, on acceptable terms, or at all; our ability to attract and retain key personnel, including key management personnel; our ability to retain and reengage key vendors and engage additional vendors, as needed; our ability to obtain approvals and permits to construct and operate our farms without delay; increases in interest rates; delays and defects that may prevent the commencement of farm operations; rising inflation rates; our ability to finance our activities on acceptable terms; an inabilityOhio farm through the placement of municipal bonds, which may require restrictive debt covenants that could limit our control over the farm’s operation and restrict our ability to utilize any cash that the farm generates; our ability to manage our growth, which could adversely affect our business; risks related to potential strategic acquisitions, investments or mergers; high customer concentration, which exposes us to various risks faced by our major customers; ethical, legal, and social concerns about genetically engineered products; our ability to gain consumer acceptance of our genetically engineered Atlantic salmon (“GE Atlantic salmon” or “AquAdvantage salmon”) product; the quality and quantity of the salmon that we harvest; a significant fish mortality event in our broodstock or our production facilities; the loss of our GE Atlantic salmon broodstock; disease outbreaks, which can increase the cost of production and/or reduce production harvests; a shutdown, material damage to any of our farms, or lack of availability of power, fuel, oxygen, eggs, water, or other key components needed for our operations; our ability to efficiently and cost-effectively produce and sell salmon at large commercial scale; any contamination of our products, which could subject us to product liability claims and product recalls; security breaches, cyber-attacks and other disruptions could compromise our information, expose us to fraud or liability, or interrupt our operations; our dependence on third parties for the processing, distribution, and sale of our products; any write-downs of the value of our inventory; business, political, or economic disruptions or global health concerns; adverse developments affecting the financial services industry; industry volatility, including fluctuations in commodity prices of salmon; restrictions on Atlantic salmon farming in certain states; agreements that require us to pay a significant portion of our future revenue to third parties; our ability to receive additional government research grants and loans; international business risks, including exchange rate fluctuations; our ability to use net operating losses and other tax attributes, which may be subject to certain limitations; our ability to maintain regulatory approvals for our GE Atlantic salmon and our farm sites and obtain new approvals for farm sites and the sale of our products in sufficient volumeother markets; our ability to continue to comply with U.S. Food and atDrug Administration regulations and foreign regulations; significant regulations in the markets in which we intend to sell our products; significant costs complying with environmental, health, and safety laws and regulations, and any failure to comply with these laws and regulations; increasing regulation, changes in existing regulations, and review of existing regulatory decisions; lawsuits by non-governmental organizations and others who are opposed to the development or commercialization of genetically engineered products; risks related to the use of the term “genetically engineered,” which will need to be included as part of the acceptable costmarket name for our GE Atlantic salmon, and prices;bioengineering disclosures provided in accordance with U.S. Department of Agriculture regulations; competitors and potential competitors may develop products and technologies that make ours obsolete or garner greater market share than ours; any inabilitytheft, misappropriation, or reverse engineering of our products could result in competing technologies or products; our ability to protect our proprietary technologies and intellectual property and other proprietary rights and technologies; the effects of changes in applicable laws, regulations and policies;rights; our ability to secure any necessary regulatory approvals;enforce our intellectual property rights; volatility in the degree of market acceptanceprice of our products our failure to retain and recruit key personnel; the price and volatilityshares of our common stock; our ability to regain compliance or otherwise maintain compliance with theour listing requirements of, and remain listed on the Nasdaq Capital Market;Stock Market LLC (“Nasdaq”); our success in growing, or our perceived ability to grow, our GE Atlantic salmon successfully and profitably at commercial scale; an active trading market for our businesscommon stock may not be sustained; our status as a “smaller reporting company” and financial condition,a “non-accelerated filer” may cause our shares of common stock to be less attractive to investors; any issuance of preferred stock with terms that could dilute the voting power or reduce the value of our common stock; provisions in our corporate documents and Delaware law could have the impacteffect of general economic, public health, industrydelaying, deferring, or political conditionspreventing a change in control of us; our expectation of not paying cash dividends in the United States or internationally. foreseeable future; and other risks and uncertainties discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”). For additional disclosure regarding these and other risks faced by us,AquaBounty, see disclosures contained in ourAquaBounty’s public filings with the Securities and Exchange Commission,SEC, including the “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.10-Q. You should consider these factors in evaluating the forward-looking statements included in this proxy statement and not place undue reliance on such statements. The forward-looking statements are made as of the date hereof, and we undertakeAquaBounty undertakes no obligation to update such statements as a result of new information, except as required by law. i

2024 PROXY STATEMENT TABLE OF CONTENTS

2 Mill & Main Place,

233 Ayer Road, Suite 3954 Maynard,Harvard, Massachusetts 0175401451

PROXY STATEMENT FOR THE SPECIALANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 12, 2023MAY 23, 2024

ABOUT THE SPECIALANNUAL MEETING What is the Purpose of the Annual Meeting? This Proxy Statementproxy statement and the accompanying form of proxy are being furnishedmade available to the stockholders of AquaBounty Technologies, Inc. (“we,” “us,” “AquaBounty” or the “Company”) in connection with the solicitation of proxies by theour Board of Directors (the “Board”) of AquaBounty Technologies, Inc. (“we,” “us,” “our,” “AquaBounty” or the “Company”Board”) for use at our specialannual meeting of stockholders (the “Special Meeting”) to be held on October 12, 2023,May 23, 2024, at 8:30 a.m., Eastern Time, at 2 Mill & Main Place,233 Ayer Road, Suite 395, Maynard,4, Harvard, MA 01754,01451, and any adjournments, continuations or postponements thereof. What is the purpose of the Special Meeting?

The purpose of the Special Meeting is to act uponmeeting will be held for the following matters outlined in the notice of Internet Availability of Proxy Materials for the Special Meeting (the “Notice”):purposes: To approve an amendment to our Third Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to approve a reverse stock split (the “Reverse Stock Split”) of our common stock, par value $0.001 per share (“Common Stock”), and an associated reduction in the number of shares of Common Stock we are authorized to issue (the “Authorized Capital Change”), from 150,000,000 to 75,000,000 (the “Reverse Stock Split Proposal”

| · | | to elect seven directors to serve on our Board for a one-year term of office until the next annual meeting of stockholders, with each director to hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal (“Proposal 1”); |

| · | | to ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (“Proposal 2”); |

| · | | to approve, on a non-binding, advisory basis, the compensation paid to our named executive officers (“Proposal 3”); and |

| · | | to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Reverse Stock Split Proposal (the “Adjournment Proposal”).

After careful consideration,the our Board recommends a vote “FOR” the Reverse Stock Split Proposal (Proposal 1); and “FOR” the Adjournment Proposal (Proposal 2). As described in this Proxy Statement, our Board believes that it is in the best interestelection of each of the Company and its stockholders that the Board has the ability to effect,director nominees listed in its discretion, the Reverse Stock Split and the Authorized Capital Change to improve the price level of our Common Stock so that we are able to maintain continued compliance with the minimum bid price requirement and minimize the risk of delisting from the Nasdaq Capital Market.

What are the consequences if the Reverse Stock Split Proposal (Proposal 1) is not approved by stockholders?

If Proposal 1 is not approved by stockholders, our Common Stock may be delisted from the Nasdaq Capital Market. Any delisting from the Nasdaq Capital Market would likely result in further reductions in the market prices of our Common Stock, substantially limit the liquidity of our Common Stock, not only in the number of shares that could be bought and sold at a given price, which might be depressed by the relative illiquidity, but also through delays in the timing of transactionsvote “FOR” Proposals 2 and reduction in media and securities analyst coverage, and materially adversely affect our ability to raise capital or pursue strategic restructuring, refinancing or other transactions on acceptable terms, or at all. Delisting from the Nasdaq Capital Market could also have other negative results, including the potential loss of institutional investor interest, fewer business development3.

1

opportunities, and the inability to raise additional required capital. In addition, the SEC has adopted rules governing “penny stocks” that impose additional burdens on broker-dealers trading in stock priced at or below $5.00 per share, unless listed on certain securities exchanges. In the event of a delisting, we would attempt to take actions to restore our compliance with the Nasdaq Capital Market’s listing requirements, but we can provide no assurance that any such action taken by us would allow our Common Stock to become listed again, stabilize the market price or improve the liquidity of our Common Stock, prevent our Common Stock from dropping below the minimum bid price requirement or prevent future non-compliance with the Nasdaq Capital Market’s listing requirements.

Where can I obtain proxy-related materials and/or what should I do if I received more than one copy of the Notice and proxy materials? A copy of our proxy materials is available, free of charge, on www.envisionreports.com/AQB, the Securities and Exchange Commission (“SEC”) website at www.sec.gov, and our corporate website at www.aquabounty.com.www.aquabounty.com. By referring to our website, we do not incorporate our website or any portion of that website by reference into this Proxy Statement.proxy statement. We have elected to provide access to our proxy materials over the Internet. Accordingly, on or about September 1, 2023,April 12, 2024, we expect to send thea Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of the record date entitled to vote at the Special Meeting.our annual meeting. The Notice will provide instructions on how to access our proxy statement and annual report, along with how to vote via the Internet or by telephone. Instructions on how to request a printed copy of the proxy materials will also be provided in the Notice. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help minimize our costs associated with printing and distributing our proxy materials and lessen the environmental impact of the Special Meeting.our annual meeting of stockholders. If your shares are held in more than one account at a brokerage firm, bank, broker-dealer, or other similar organization (a “broker and/or other nominee”), you may receive more than one copy of the proxy materials. Please follow the voting instructions on the proxy cards or voting instruction forms, as applicable, and vote all proxy cards or voting instruction forms, as applicable, to ensure that all of your shares are voted. We encourage you to have all accounts registered in the same name and address whenever possible. If you are a registered holder, you can accomplish this by contacting our transfer agent, Computershare, at (800) 736-3001 or in writing to Computershare Investor Services, PO. Box 43006,43078, Providence, Rhode Island 02940-3006.02940-3078. If your shares are held in an account at a broker and/or other nominee, you can accomplish this by contacting that organization. Why did multiple stockholders at my address receive only one copy of the Notice and proxy materials? Some broker and/brokers or other nominees may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Notice or set of proxy materials is being delivered to multiple stockholders sharing an address unless we have received contrary instructions. We will promptly deliver a separate copy of any of these documents to you if you write to us

at 2 Mill & Main Place,233 Ayer Road, Suite 395, Maynard,4, Harvard, MA 01754,01451, Attention: Corporate Secretary or call us at (978) 648-6000. If you want to receive separate copies of the Notice or proxy materials or Annual Reports on Form 10-K in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your broker and/or other nominee, or you may contact us at the above address or telephone number. What is the quorum requirement to hold the Special Meeting?annual meeting? Our outstanding Common Stock is the only class of securities entitled to vote at the Special Meeting, and each issued and outstanding, shareand each holder of our Common Stock is entitled to one vote for each share of the Common Stock standing in the name of such stockholder on each matter submitted to a votethe books of our stockholders.the Company on the record date for the annual meeting. Common stockholders of record at the close of business on August 21, 2023,March 25, 2024, the record date for the Special Meeting,annual meeting, are entitled to notice of and to vote at the Special Meeting.annual meeting. The presence at the Special Meeting, in person or by proxy, of the holders of a majority of the stock issued and outstanding and entitled to vote as of the record date, present in person or represented by proxy, will constitute a quorum at the annual meeting. On March 25, 2024, the record date for the annual meeting, there were 3,857,444 shares of Common Stock issued and outstanding as of August 21, 2023 will constitute a quorum.outstanding. 2

For purposes of determining the presence or absence of a quorum, abstentions and broker non-votes if any, will be counted as present. If a quorum is not present, or represented at the annual meeting, the stockholders entitled to vote at the annual meeting, present in person or represented by proxy, will have the power to adjourn the meeting may be adjournedfrom time to time until a quorum is obtained.present or represented. What is the vote required for each of the proposals? Approval

A summary of our annual meeting proposals and applicable vote standards is set forth below. Proposal 1 the Reverse Stock Split Proposal, willrequires a plurality vote. Proposals 2 and 3 require the affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote thereon. The approval of Proposal 2, the Adjournment Proposal, will require the affirmative vote of the holders of a majority of the outstanding shares of Common Stockstock present in person or represented by proxy at the Special Meetingmeeting and entitled to vote on the Adjournment vote. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Proposal | | Vote Options | | Vote Required | | Effect of Withhold Votes or Abstentions | | Broker

Non-Votes (if any) | | | | | | | | Election of Directors (Proposal 1) | | FOR WITHHOLD | | At least one FOR vote. Nominees receiving the highest number of “FOR” votes are elected until all board seats are filled. In an uncontested election, where the number of nominees and available board seats are equal, election requires only a single vote or more. | | No Effect | | No Effect | | | | | | | | Ratification of Appointment of Independent Auditors (Proposal 2) | | FOR AGAINST ABSTAIN | | Majority of shares present in person or represented by proxy at the meeting and entitled to vote on the proposal and which has actually been voted. | | No Effect | | No Effect (1) | | | | | | | | Advisory Vote to Approve the Compensation of our Named Executive Officers (Proposal 3) | | FOR AGAINST ABSTAIN | | Majority of shares present in person or represented by proxy at the meeting and entitled to vote on the proposal and which has actually been voted. | | No Effect | | No Effect | | | | | | | | | | | | | |

(1) This proposal is considered to be a “routine” matter. Accordingly, if you beneficially own your shares and which have actually been voted. Abstentions. Abstentions will have the same effect as a vote against Proposal 1, the Reverse Stock Split Proposal. Abstentions will have no effect on the outcome of the Adjournment Proposal (Proposal 2), as abstentions do not constituteprovide voting instructions, your broker or other nominee has discretionary authority to vote your shares that have actually been voted.on this proposal. Accordingly, we do not expect there to be any broker non-votes on this proposal.

Broker Non-Votes.Non-Votes If you are a beneficial owner of shares held by a broker and/or other nominee and you do not instruct your broker and/or other nominee how to vote your shares, your broker and/or other nominee may still be able to vote your shares in its discretion. Under the rules of the New York

Stock Exchange, (“NYSE”), which are also applicable to Nasdaq-listed companies, brokers and/or other nominees that are subject to NYSENew York Stock Exchange rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under NYSENew York Stock Exchange rules but not with respect to “non-routine”“non-routine” matters. A broker non-vote occurs when a broker and/or other nominee has not received voting instructions from the beneficial owner of the shares, and the broker and/or other nominee cannot vote the shares at its discretion because the matter is considered “non-routine”“non-routine” under NYSE rules. Proposals 1 and 3 are considered to be “non-routine” under New York Stock Exchange rules such that your broker or didother nominee may not vote theyour shares on a “routine” matter. Eachthose proposals in the absence of Proposals 1 andyour voting instructions. Conversely, Proposal 2 is considered to be a “routine” matter under NYSE rules;New York Stock Exchange rules, and thus if you do not return voting instructions to your broker and/or other nominee by its deadline, or you provide a proxy without giving specific voting instructions, your shares may be voted by your broker and/or other nominee in its discretion on each of Proposals 1 andProposal 2. In the event that any broker non-votes are received, they will have the same effect as a vote against Proposal 1, the Reverse Stock Split Proposal, and will have no effect on the outcome of Proposal 2, the Adjournment Proposal. What are the procedures for voting?

Your Vote Your vote is very important. Whether or not you plan to attend the Special Meeting,annual meeting, please vote by proxy in accordance with the instructions on your proxy card or voting instruction card (from your broker and/or other nominee).

Stockholders of Record If your shares are registered directly in your name with our transfer agent, Computershare, you are a stockholder of record, and you received the proxy materialsNotice by mail with instructions regarding how to view our proxy materials on the Internet, how to receive a paper or email copy of the proxy materials, and how to vote by proxy.proxy in advance of the meeting. You can also vote in person at the Special Meeting or by proxy.proxy during the annual meeting. There are three ways stockholders of record can vote by proxy:proxy in advance of the meeting: (1) by telephone (by following the instructions on the proxy card); (2) by Internet (by following the instructions provided on the proxy card); or (3) by mail, (by completing and returning the proxy card enclosed in the proxy materials prior to the Special Meeting)annual meeting). Unless there are different instructions, on the proxy card, all shares represented by valid proxies (and not revoked before they are voted) will be voted as follows at the Special Meeting:annual meeting: FOR the Reverse Stock Split Proposal in Proposal 1; and

| · | | FOR the election of each of the director nominees listed in Proposal 1 (unless the authority to vote for the election of any such director nominee is withheld); |

FOR the Adjournment Proposal in Proposal 2.

| · | | FOR the ratification of the appointment of Deloitte as our independent registered public accounting firm as described in Proposal 2; and |

| · | | FOR the approval, on a non-binding, advisory basis, of the compensation paid to our named executive officers as described in Proposal 3. |

If you provide specific voting instructions, your shares will be voted as instructed. Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day until the polls close at 11:59 p.m., Eastern Time, on October 11, 2023.during the meeting. 3

Beneficial Owners of Shares Held in Street Name If your shares are held in an account at a broker and/or other nominee, then you are the beneficial owner of shares held in “street name,” and such organization forwarded to you the proxy materials. There are two ways beneficial owners of shares held in street name can vote by proxy in accordance withYou should follow the instructions provided to you by yourfrom such broker and/or other nominee: (1) by mail (by following the instructions on the voting instruction form); or (2) by Internet (by following the instructions on the voting instruction form). As a beneficial owner, you are also invitednominee in order to attend the Special Meeting, but since you are not a stockholder of record, you may not vote your shares in person at the Special Meeting unless you request and obtain a valid “legal proxy” from your broker, which is a written document that will give you the legal right to vote the shares at the Special Meeting. You must also satisfy the Special Meeting admission criteria set out below.shares. Although we do not know of any business to be considered at the Special Meetingannual meeting other than the proposals described in the proxy statement, if any other business is presented at the Special Meeting,annual meeting, your signed proxy or your authenticated Internet or telephone proxy will give authority to each of Sylvia Wulf, David A. Frank and Angela M. Olsen to vote on such matters at his or her discretion. YOUR VOTE IS IMPORTANT. PLEASE VOTE WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIALANNUAL MEETING IN PERSON. How do I attend the meeting? You are entitled to attend the Special Meetingannual meeting only if you were a stockholder of record as of the record date, or if you are a “beneficial owner” of shares held in “street name” as of the record date and you hold a valid legal proxy for the annual meeting, executed in your favor by your broker and/or other nominee, for the Special Meeting.nominee. Registration will begin at 8:00 a.m., Eastern Time on the date of the Special Meetingannual meeting, and seating will begin immediately after. Since seating is limited, admission to the Special Meetingannual meeting will be on a first-come, first-served basis. If you plan to attend, in addition to the legal proxy required if you are a “beneficial owner” of your shares, please note that youall attendees should be prepared to present government-issued photo identification for admittance, such as a passport or driver’s license. IfIn addition, if you are the “beneficial owner” of your shares, you will also need proof of ownership as of the record date, such as the Notice, the voting instruction card provided by your broker or other nominee, your most recent account statement prior to the record date, a copy of the voting instruction card provided by your broker, or similar evidence of ownership. If you do not have a valid picture identification or proof of ownership of our stock, and a valid picture identification, you may be

denied admission to the Special Meeting.annual meeting. If you do not comply with each of the foregoing requirements, you may not be admitted to the Special Meeting.annual meeting. How do I revoke a proxy? If you are a stockholder of record, you may revoke your proxy at any time before it is actually voted at the Special Meetingannual meeting by: delivering written notice of revocation to our Corporate Secretary at 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754, which must be received by our Corporate Secretary prior to the start of the Special Meeting;

| · | | delivering written notice of revocation to our Corporate Secretary at 233 Ayer Road, Suite 4, Harvard, Massachusetts 01451, which must be received by our Corporate Secretary prior to the start of the annual meeting; |

| · | | submitting a later-dated proxy prior to the applicable cutoff times, as described above; or |

| · | | attending the annual meeting and voting in person. |

submitting a later-dated proxy prior to the applicable cutoff times, as described above; or

by attending the Special Meeting and voting in person.

Your attendance at the Special Meetingannual meeting will not, by itself, constitute a revocation of your proxy. You may also be represented by another person attending the Special Meetingannual meeting by executing an acceptable form of proxy designating that person to act on your behalf. Shares may only be voted by or on behalf of the record holder of shares as of the record date, as indicated in our stock transfer records.

If your shares are held in “street name,” then you must provide voting instructions to the broker and/or other nominee, as the appropriate record holder, so that such person can vote the shares in 4

accordance with your preferences. In the absence of such voting instructions from you, the record holder will be entitled to vote your shares on “routine” matters. Pleaseplease contact your broker and/or other nominee if you would like directions on how you may change or revoke your voting instructions.

Who is making this solicitation? This solicitation is made on behalf of our Board, and we will pay the costs of solicitation. Copies of solicitationproxy materials will be furnished to brokers and/or other nominees holding shares in their names that are beneficially owned by others so that they may forward the solicitation materialproxy materials to such beneficial owners upon request. We will reimburse brokers and/or other nominees for reasonable expenses incurred by them in sending proxy materials to our stockholders. In addition to the solicitation of proxies by mail, our directors, officers, and employees may solicit proxies by telephone, facsimile, or personal interview. No additional compensation will be paid to these individuals for any such services. We have engaged a third-party solicitor, Georgeson LLC, who may solicit proxies by telephone or by other means of communication on our behalf. The cost for this service is estimated at $25,000,$20,000, including expenses. In addition, we have agreed to indemnify Georgeson LLC against certain claims, liabilities, losses, damages and expenses arising out of or in connection with these services. How can I find the voting results? We plan to announce preliminary voting results at the meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Special Meeting.annual meeting. 5

MATTERS TO BE CONSIDERED AT THE SPECIAL MEETING

PROPOSAL 1:

REVERSE STOCK SPLIT PROPOSAL

| OUR BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR

THE REVERSE STOCK SPLIT PROPOSAL.

|

Introduction

Our Board has unanimously approved and declared advisable an amendment to our Charter (the “Amendment”), which would effect a reverse stock split of all issued and outstanding shares of our Common Stock (along with any shares of Common Stock held by the Company in treasury), at a ratio ranging from 1-for-15 to 1-for-20, inclusive, and an associated reduction in the number of shares of Common Stock we are authorized to issue, from 150,000,000 to 75,000,000, should such Amendment be approved by the stockholders pursuant to this Proposal 1 and if the Board determines to effect the Reverse Stock Split. The decision whether or not to effect a Reverse Stock Split and the ratio of any Reverse Stock Split will be determined by the Board following the SpecialStockholder Proposals for 2025 Annual Meeting and prior to December 31, 2023. Our Board has recommended that the proposed Amendment be presented to our stockholders for approval.

Our stockholders are being asked to approve the Reverse Stock Split and the Authorized Capital Change pursuant to this Proposal 1 and to grant authorization to the Board to determine, at its option, whether to implement a Reverse Stock Split, including its specific timing and ratio, and the Authorized Capital Change. Should we receive the required stockholder approvals for Proposal 1, the Board will have the sole authority to elect, at any time on or prior to December 31, 2023, and without the need for any further action on the part of our stockholders, whether to effect a Reverse Stock Split and the number of whole shares of our Common Stock, between and including fifteen (15) and twenty (20), that will be combined into one share of our Common Stock (along with the Authorized Capital Change).

By approving Proposal 1, our stockholders will: (a) approve the Amendment pursuant to which any whole number of issued shares of Common Stock between and including fifteen (15) and twenty (20), as determined by our Board, could be combined into one share of Common Stock; (b) approve the Amendment pursuant to which the number of shares of Common Stock we are authorized to issue could be reduced from 150,000,000 to 75,000,000; and (c) authorize the Company to file the Amendment with the Secretary of State of the State of Delaware, in each case as determined by the Board at its sole option. The Board may also elect not to undertake any Reverse Stock Split and the Authorized Capital Change and therefore abandon the Amendment. No further action on the part of stockholders will be required to either implement or abandon the Reverse Stock Split or the Authorized Capital Change. If the Amendment has not been filed with the Secretary of State of the State of Delaware by the close of business on December 31, 2023, our Board will abandon the Reverse Stock Split and the Authorized Capital Change, and stockholder approval would again be required prior to implementing a reverse stock split of our Common Stock or reduction of our authorized share capital.

The form of the proposed Amendment to effect the Reverse Stock Split and the Authorized Capital Change is as set forth in Appendix A (subject to the Board’s selection of the applicable reverse stock split ratio). The Reverse Stock Split, if effected, would affect all of our holders of Common Stock uniformly, except with respect to the treatment of fractional shares. The following description of the proposed Amendment, Reverse Stock Split and Authorized Capital Change is a summary and is subject to the full text of the proposed Amendment.

Background — Reverse Stock Split

On October 31, 2022, we received a letter (the “Letter”) from The NASDAQ Stock Market LLC (“Nasdaq”) notifying us that, because the closing bid price for our Common Stock had been below $1.00 per share for the

6

previous 30 consecutive business days, it no longer complied with the minimum bid price requirement for continued listing on the Nasdaq Capital Market. The Letter had no immediate effect on our listing on the Nasdaq Capital Market or on the trading of our Common Stock. The Letter provided us with a compliance period of 180 calendar days, or until May 1, 2023, to regain compliance. We were unable to regain compliance with the bid price requirement by May 1, 2023. However, on May 2, 2023, we received a notice from Nasdaq granting us an additional 180 calendar days, or until October 30, 2023, to regain compliance with the minimum $1.00 bid price per share requirement for continued listing on the Nasdaq Capital Market. Nasdaq determinedStockholder proposals that we were eligible for the second compliance period due to us meeting the continued listing requirement for market value of publicly held shares and all other applicable requirements for initial listing on the Nasdaq Capital Market, with the exception of the bid price requirement, and our written notice of our intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary. To regain compliance, the closing bid price of our Common Stock must be at least $1.00 per share for a minimum of 10 consecutive business days during the second compliance period.

We have been monitoring the closing bid price of the Common Stock, but as of August 1, 2023, our closing bid price has not met the minimum threshold of $1.00 per share for a minimum of 10 consecutive business days. There can be no assurance that we will regain compliance with the minimum bid price requirement by the end of the second 180-day compliance period on October 30, 2023 or otherwise maintain compliance with the other listing requirements.

If we do not meet the minimum bid price requirement by the end of the second 180-day compliance period, our shares will be subject to delisting by Nasdaq. If an issuer’s equity security is delisted from the Nasdaq Capital Market, it may be forced to seek to have its equity security traded or quoted on the OTC Bulletin Board or in the “pink sheets.” Such alternatives are generally consideredintended to be less efficient marketspresented at our 2025 annual meeting of stockholders and not as broad as the Nasdaq Capital Market, and therefore less desirable. Accordingly, the delisting, or even the potential delisting, of our Common Stock could have a negative impact on the liquidity and market price of our Common Stock.

As such, our Board believes that it is in the best interest of the Company and its stockholders that the Board has the ability to effect, in its discretion, the Reverse Stock Split to improve the price level of our Common Stock so that we are able to regain compliance with the minimum bid price requirement and minimize the risk of delisting from the Nasdaq Capital Market.

Any delisting from the Nasdaq Capital Market would likely result in further reductions in the market prices of our Common Stock, substantially limit the liquidity of our Common Stock, not only in the number of shares that could be bought and sold at a given price, which might be depressed by the relative illiquidity, but also through delays in the timing of transactions and reduction in media and analyst coverage, and materially adversely affect our ability to raise capital or pursue strategic restructuring, refinancing or other transactions on acceptable terms, or at all. Delisting from the Nasdaq Capital Market could also have other negative results, including the potential loss of institutional investor interest, fewer business development opportunities, and the inability to raise additional required capital. In addition, the SEC has adopted rules governing “penny stocks” that impose additional burdens on broker-dealers trading in stock priced at below $5.00 per share, unless listed on certain securities exchanges. In the event of a delisting, we anticipate taking actions to try to meet the Nasdaq Capital Market’s initial listing standards and submitting an application for our Common Stock to be listed on the Nasdaq Capital Market, but we can provide no assurance that any such action taken by us would allow our Common Stock to become listed again, stabilize the market price or improve the liquidity of our Common Stock, prevent our Common Stock from dropping below the minimum bid price requirement or prevent future non-compliance with the Nasdaq Capital Market’s listing requirements, whether as to minimum bid price or otherwise.

In addition to regaining compliance with the Nasdaq Capital Market’s minimum bid price listing requirements, we also believe that the Reverse Stock Split and an increaseincluded in our stock price may make our Common Stock more attractive to a broader range of institutional and other investors (including funds that are prohibited from buying stocks whose price is below a certain threshold) and facilitate higher levels of institutional stock

7

ownership, where investment policies generally prohibit investments in lower-priced securities, as well as better enable us to raise funds to help finance operations. We understand that many brokerage firms and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers, which reduces the number of potential purchasers of our Common Stock. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically less attractive to brokers. Investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, we believe the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower-priced stocks. Further, lower-priced stocks have a perception in the investment community as being more risky and speculative, which may negatively impact not only the price of our Common Stock, but also our market liquidity.

Background — Authorized Capital Change

As a matter of Delaware law, the implementation of the Reverse Stock Split does not require a reduction in the total number of authorized shares of Common Stock. However, the Amendment will also effect the Authorized Capital Change. The Authorized Capital Change will not be proportionalproxy statement relating to the ratio of the Reverse Stock Split. Accordingly, while the Authorized Capital Change will reduce the number of shares authorized for issuance on an absolute basis, it will have the effect of increasing the number of shares of Common Stock authorized for issuance relative2025 annual meeting, pursuant to the number of shares outstanding (although such relative increase will be smaller than if we did not effect the Authorized Capital Change). The Board believes the relative increase in the number of shares of Common Stock authorized for issuance is in the best interest of the Company and its stockholders.

As we have disclosed in our other SEC filings, since inception, we have incurred cumulative net operating losses and negative cash flows from operations and we expect this to continue for the foreseeable future. As of June 30, 2023, we have $43.8 million in cash and cash equivalents, and restricted cash, a significant portion of which is required to fund our current liabilities and other contractual obligations. Our ability to continue as a going concern is dependent upon our ability to raise additional capital, and there can be no assurance that such capital will be available in sufficient amounts on terms acceptable to us, or at all. This raises substantial doubt about our ability to continue as a going concern over the next 12 months. Until such time, if ever, as we can generate positive operating cash flows, we may be required to finance our cash needs through a combination of equity offerings, debt financings, government or other third-party funding, strategic alliances, and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of holders of our common stock will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of holders of our common stock. There can be no guarantee that we will be successful in raising additional funds in the future through financings, sales of our products, government grants, loans, or from other sources or transactions, and if we are unable to raise such funds, we will exhaust our resources and will be unable to maintain our currently planned operations. If we cannot continue as a going concern, our stockholders would likely lose most or all of their investment in us.

The relative increase is designed to enable us to raise additional capital in the future via equity and convertible debt financings, as well as to meet our obligationsRule 14a-8 promulgated under outstanding options, restricted stock unitsand convertible securities, and our equity compensation plans, while retaining flexibility to respond to other future business needs and opportunities. The additional authorized shares would enable us to issue shares in the future in a timely manner and under circumstances we consider favorable without incurring the risk, delay and potential expense incident to obtaining stockholder approval for a particular issuance. For example, the shares may be used for: capital raising transactions involving equity or convertible debt securities; financing the development and construction of additional farms, including the Ohio farm; providing equity incentives to employees, directors, consultants or advisors under equity incentive plans or otherwise; establishing strategic relationships with other companies and other potential strategic transactions; expanding our business through the acquisition of other businesses, technologies or products; stockholder right plans; stock splits or stock dividends; other corporate purposes.

8

We have engaged an exclusive financial advisor and sole placement agent to explore a wide range of transactions, including, without limitation, a transaction involving a co-investment by us with one or more non-affiliated entities and a private placement of our equity or equity-linked securities to a limited number of sophisticated investors, that could result in the issuance of Common Stock, as they arise or as our needs require, which could occur promptly following the effectiveness of the Amendment. However, we have no current agreement or commitment to issue additional shares of Common Stock, except for issuances of Common Stock as described below under the heading “Fractional Shares” and upon the exercise of its outstanding options and conversion of restricted stock units and other equity securities.

Reverse Stock Split

The Reverse Stock Split would affect all stockholders uniformly and would not affect any stockholder’s percentage ownership interest in the Company, except to the extent that the Reverse Stock Split results in any stockholders owning a fractional share, the treatment of which is described below.

Our current authorized share capital is 150,000,000 shares of Common Stock, and 5,000,000 shares of preferred stock, par value $0.001 per share (the “Preferred Stock”). As of July 31, 2023, 71,358,249 shares of Common Stock and no shares of Preferred Stock were outstanding. Accordingly, our current authorized but unissued share capital is 78,641,751 shares of Common Stock and 5,000,000 shares of Preferred Stock.

Therefore, as a result of the Reverse Stock Split, the number of outstanding shares of Common Stock would decrease by a specified amount. The determination of the specific ratio for the Reverse Stock Split will not affect the number of shares of Common Stock the Company is authorized to issue after the Reverse Stock Split. Regardless of the ratio, as a result of the Authorized Capital Change, the Company will be authorized to issue 75,000,000 shares of Common Stock after the Reverse Stock Split. Assuming 71,358,249 shares remain outstanding at the time of the Reverse Stock Split, after giving effect to the Authorized Capital Changeand theReverse Stock Split that would result from the listed hypothetical Reverse Stock Split ratios, without giving effect to the treatment of fractional shares, our authorized but unissued Common Stock would be as follows:

| | | | | | | | | Shares Authorized (2) | | Current Shares Outstanding (3) | | Reverse Split Ratio (1) | | Post Reverse Split | | | Shares Outstanding | | Unissued Shares | 75,000,000 | | 71,358,249 | | 15 | | 4,757,217 | | 70,242,783 | 75,000,000 | | 71,358,249 | | 16 | | 4,459,891 | | 70,540,109 | 75,000,000 | | 71,358,249 | | 17 | | 4,197,545 | | 70,802,455 | 75,000,000 | | 71,358,249 | | 18 | | 3,964,348 | | 71,035,652 | 75,000,000 | | 71,358,249 | | 19 | | 3,755,698 | | 71,244,302 | 75,000,000 | | 71,358,249 | | 20 | | 3,567,913 | | 71,432,087 |

(1) | Proposed ratios ranging from 1-for-15 to 1-for-20, inclusive.

|

(2) | Total authorized shares of Common Stock giving effect to the Authorized Capital Change.

|

(3) | Does not include shares reserved for future issuance pursuant to outstanding options, restricted stock units and future awards under the Company’s 2016 Equity Incentive Plan, as amended (the “2016 Plan”) and the 2006 Equity Incentive Plan, as amended (the “2006 Plan”). Please note that between the date of this Proxy Statement and the date of the Special Meeting, we could engage in transactions involving the issuance of securities that would increase the number of issued or issuable shares from the numbers reflected in the above tables.

|

The actual number of shares outstanding after giving effect to the Reverse Stock Split, if implemented, will depend on the reverse stock split ratio that is ultimately determined by the Board. No shares of our preferred stock are outstanding and the total number of authorized shares of preferred stock will not be affected by the Reverse Stock Split.

The Reverse Stock Split would not change the par value of the Common Stock. If any stockholder would otherwise receive a fractional share of Common Stock as a result of the Reverse Stock Split, our Board will issue

9

an additional fraction of a share of Common Stock to such holder, which fraction, when combined with the fraction resulting from the Reverse Stock Split, will equal a whole share of Common Stock, such that no holder will continue to hold fractional shares following the Reverse Stock Split.

Criteria to be Used for Determining Reverse Stock Split Ratio

The purpose of a range for the Reverse Stock Split is to give the Board the flexibility to meet business needs as they arise, to take advantage of favorable opportunities and to respond to a changing investment environment, such as stock price fluctuations, higher inflation, higher interest rates and related factors. In determining which reverse stock split ratio to implement, if any, following receipt of stockholder approval of the Amendment to effect the Reverse Stock Split, the Board may consider, among other things, various factors, such as:

the historical and expected trading prices and trading volumes of our Common Stock;

The Nasdaq Capital Market Continued Listing Standards requirements;

the number of shares of our Common Stock outstanding;

the then-prevailing trading prices and trading volumes of our Common Stock and the expected impact of the Reverse Stock Split and the Authorized Capital Change on the trading market for our Common Stock in the short- and long-term;

overall trends in the stock market;

the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs;

business developments and our actual and projected financial performance; and

prevailing general market and economic conditions.

Our Board reserves the right to abandon the Reverse Stock Split and the Authorized Capital Change without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of the State of Delaware of the Amendment, even if the authority to effect a Reverse Stock Split has been approved by our stockholders at the Special Meeting. If the Reverse Stock Split Proposal is approved, we could effect the Reverse Stock Split and the Authorized Capital Change at any time after the Special Meeting until December 31, 2023. By voting in favor of the Reverse Stock Split Proposal, you are expressly also authorizing the Board to delay, not to proceed with, and abandon, the Reverse Stock Split and the Authorized Capital Change if it should so decide, in its sole discretion, that such action is in the best interests of the stockholders.

Effectiveness of Reverse Stock Split and Authorized Capital Change

The Reverse Stock Split and Authorized Capital Change would become effective at the effective time set forth in the Amendment (the “Effective Time”).

Procedure for Implementing the Reverse Stock Split and Authorized Capital Change

If Proposal 1 is approved by our stockholders, our Board retains the discretion to effect the Reverse Stock Split and the Authorized Capital Change at any time prior to December 31, 2023 or not at all. Our Board will determine whether such an action is in the best interests of the Company and our stockholders, taking into consideration the factors discussed above and any other factors it considers relevant. The Reverse Stock Split and the Authorized Capital Change would be implemented by filing the Amendment with the Secretary of the State of Delaware, setting forth the ratio used in the Reverse Stock Split

If the Reverse Stock Split is effected, then after the Effective Time, our Common Stock will have a new Committee on Uniform Securities Identification Procedures (“CUSIP”) number, which is a number used to

10

identify our equity securities, and stock certificates with the older CUSIP number will need to be exchanged for stock certificates with the new CUSIP number by following the procedures described below. Our Common Stock will continue to be listed on the Nasdaq Capital Market under the symbol “AQB” subject to any future change of listing of our securities.

Principal Effects of the Amendment

Reverse Stock Split — General

The Reverse Stock Split, if implemented by the Board, will reduce the total number of outstanding shares of Common Stock based on the split ratio determined by the Board in its discretion, and it will apply automatically to all shares of our Common Stock, including shares held by the Company in treasury, shares issuable upon the exercise or conversion of outstanding stock options, restricted share units, and other equity securities. The Reverse Stock Split would be effected simultaneously for all shares of our Common Stock, and the split ratio would be the same for all shares of Common Stock. The Reverse Stock Split would affect all of our stockholders uniformly and would not affect any stockholder’s percentage ownership interests in the Company, except with respect to the treatment of fractional shares. The principal effect of the Reverse Stock Split will be to proportionately decrease the number of outstanding shares of our Common Stock based on the split ratio selected by our Board.

Voting rights and other rights of the holders of our Common Stock will not be affected by the Reverse Stock Split, other than as a result of the treatment of fractional shares. The number of stockholders of record will not be affected by the Reverse Stock Split. If approved and implemented, the Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of our Common Stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares. Our Board believes, however, that these potential effects are outweighed by the benefits of the Reverse Stock Split.

Our Common Stock is currently registered under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must be received by us no later than December 13, 2024, which is 120 calendar days before the anniversary of the date on which this proxy statement was first distributed to our stockholders. If the date of the 2025 annual meeting is moved more than 30 days from the date of the 2024 annual meeting, the deadline for inclusion of proposals in our proxy statement for the 2025 annual meeting instead will be a reasonable time before we begin to print and we are subjectsend our proxy materials. All stockholder proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for the 2025 annual meeting.

If a stockholder wishes to request business be brought at our 2025 annual meeting of stockholders (other than matters included in our proxy statement in accordance with Rule 14a-8 under the Exchange Act), the stockholder must give advance notice to us prior to the periodic reportingdeadline (the “Bylaw Deadline”) for the annual meeting determined in accordance with our Amended and Restated Bylaws (“bylaws”) and comply with certain other requirements specified in our bylaws. Under our bylaws, in order to be deemed properly presented, the notice of a proposal, including nominations for the election of directors, must be delivered to our Corporate Secretary no later than February 26, 2025, which is 45 calendar days prior to the first anniversary of the Exchange Act. Afterdate on which we mailed the Reverse Stock Split,proxy materials for the 2024 annual meeting. However, if we will continuechange the date of the 2025 annual meeting so that it occurs more than 30 days prior to, or more than 30 days after, May 23, 2025, stockholder proposals intended for presentation at the 2025 annual meeting, but not intended to be subjectincluded in our proxy statement relating to the periodic reporting2025 annual meeting, must be delivered to or mailed and other requirementsreceived by our Corporate Secretary at 233 Ayer Road, Suite 4, Harvard, Massachusetts 01451 no later than the close of business on the 90th calendar day prior to the 2025 annual meeting or the 20thcalendar day following the day on which public disclosure of the Exchange Act. The Reverse Stock Split woulddate of the 2025 annual meeting is first made (the “Alternate Date”). We also encourage you to submit any such proposals via email to investors@aquabounty.com. If a

stockholder gives notice of such proposal after the Bylaw Deadline (or the Alternate Date, if applicable), the stockholder will not affect our securities law reporting and disclosure obligations, and we would continuebe permitted to be subjectpresent the proposal to the periodic reportingstockholders for a vote at the 2025 annual meeting. Additional requirements applicable to notices of stockholder proposals are set forth in our bylaws. In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act. You

We have not been notified by any stockholder that such stockholder intends to present a stockholder proposal from the floor at this annual meeting. The enclosed proxy grants the proxy holders discretionary authority to vote on any matter properly brought before the annual meeting or any adjournment or postponement thereof. In connection with our solicitation of proxies for our 2025 annual meeting of stockholders, we intend to file a proxy statement and WHITE proxy card with the SEC. Stockholders may obtain our proxy statement (and any amendments and supplements thereto) and other documents as and when filed with the SEC without charge from the SEC’s website at www.sec.gov.

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL 1: ELECTION OF DIRECTORS Our Board recommends that stockholders vote FOR the election of EACH OF THE director nominees listed below. Each director serving on our Board is elected for a one-year term to hold office until the next annual meeting of our stockholders until the election and qualification of his or her successor, subject to his or her earlier death, disqualification, resignation or removal. The nominees named below have agreed to serve if elected, and we have no reason to believe that they will be unavailable to serve. If, however, the nominees named below are urgedunable to consult your own tax advisorsserve or decline to determineserve at the tax consequences to youtime of the Reverse Stock Split.annual meeting, the proxies will be voted for any nominee who may be designated by our Board. Unless a stockholder specifies otherwise, a returned, signed proxy will be voted FOR the election of each of the nominees listed below. Under Delaware law, our stockholders will not be entitled to exercise dissenter’s or appraisal rights

The following table sets forth information with respect to the Reverse Stock Split.persons nominated for re-election at the annual meeting: Authorized Shares; Number

| | | | | | | | | Director | | Committees | Name | Age | Since | Position(s) | Audit | Comp | Nom-Gov | Ricardo J. Alvarez | 68 | 2021 | Lead Independent Director | | Mem | Chair | Erin Sharp | 66 | 2022 | Director | Mem | | | Gail Sharps Myers | 54 | 2021 | Director | Mem | Chair | | Christine St.Clare | 73 | 2014 | Director | Chair | | Mem | Rick Sterling | 60 | 2013 | Director | Mem | Mem | | Michael Stern | 63 | 2022 | Director | | | Mem | Sylvia A. Wulf | 66 | 2019 | Board Chair and CEO | | | |

Ricardo J. Alvarez. Dr. Alvarez joined the Board of SharesAquaBounty in March 2021. He is currently the CEO of Common Stock Available for Future Issuance The Reverse Stock Split will result inHans Kissle Foods, a reductionleading manufacturer of the total outstanding sharesfresh prepared foods. Prior to joining Hans Kissle, he served as CEO of Common StockJ&K Ingredients, a leading manufacturer of bakery ingredients globally, and shares reserved for issuance under outstanding stock options, restricted share units,as President and other equity securities. The Authorized Capital Change will not be proportional to the ratioCEO of the Reverse Stock Split. Accordingly, while the Authorized Capital Change will reduce the number of shares authorized for issuance on an absolute basis, it will have the effect of increasing the number of shares of Common Stock authorized for issuance relative to the number of shares outstanding (although such relative increase will be smaller than if we did not effect the Authorized Capital Change).

As discussed above, we expect to need to raise additional capital to fund our operations. The relative increase is designed to enable us to raise additional capitalvarious food manufacturing companies including Passport Foods (SVC), LLC, Richelieu Foods, Ruiz Foods, Anita’s Foods, Overhill Farms and Raymundo’s Food Products. In his 30 years as a leader in the future via equitypackaged food industry, Dr. Alvarez has implemented growth strategies including new go-to-market initiatives, geographic expansion and convertible debt financings,innovations of both product and packaging. Dr. Alvarez also has extensive board experience, having served on the boards of Bush Brothers Inc., Clement Pappas Inc., Ruiz Foods and Clear Springs Foods. He currently serves on the board of Phelps Pet Products Inc. Dr. Alvarez brings operational and food industry experience to our Board.

Erin Sharp. Ms. Sharp joined the Board of AquaBounty in May 2022 after retiring as Group Vice President of Manufacturing and Enterprise Sourcing for The Kroger Co. (NYSE: KR), where she was a Senior Officer having responsibility for companywide manufacturing, food safety and sourcing. Prior to her 10 years with The Kroger Co., Ms. Sharp had increasing leadership roles in operations and finance with several large consumer product companies; including Sara Lee, Nestle Dreyer’s and Frito Lay. She served as a board member for the national nonprofit organization Feeding America as well as several industry boards including American Bakers Association, where she was the first female Chair, MilkPEP and the International Dairy Association. Ms. Sharp earned a bachelor’s degree from the University of Western Ontario and a Master of Business Administration from the University of Texas. Ms. Sharp brings operational and food industry experience to our Board. 11Gail Sharps Myers. Ms. Sharps Myers joined the Board of AquaBounty in May 2021. She is the Executive Vice President, Chief Legal and Administrative Officer and Corporate Secretary at Denny’s Corporation (NASDAQ:DENN), since February 2024, and she has held senior executive roles at the company since June 2020. Prior to joining Denny’s, she served as Executive Vice President, General Counsel, Chief Compliance Officer and Secretary of American Tire Distributors, Inc. from May 2018 to May 2020, as Senior Vice President, General Counsel and Secretary at Snyder’s-Lance, Inc. (NASDAQ:LNCE) from January 2015 to March 2018 and as Senior Vice President, Deputy General Counsel, Chief Compliance Counsel and Assistant Secretary from 2014 to 2015 at US Foods, Inc. She received her Doctor of Jurisprudence from The Washington College of Law at The American University, her Master of Business Administration from Arizona State University’s W. P. Carey School of Business and her Bachelor of Arts in Political Science at Howard University. Ms. Sharps Myers’ experience and background make her well suited to serve on our Board.

Christine St.Clare. Ms. St.Clare joined the Board of AquaBounty in May 2014. She is a former Audit Partner at KPMG LLP (“KPMG”) serving publicly traded companies until 2005, after which she transferred to the Advisory Practice, working in the Internal Audit, Risk and Compliance Practice until her retirement in 2010. She also served a four-year term on KPMG’s Board of Directors,

where she chaired KPMG’s Audit and Finance Committee for three of the four years. She served on the Board of Directors for Tilray, Inc. (“Tilray”) (NASDAQ:TLRY), from their 2018 IPO through April 2021. At Tilray, she chaired the Audit Committee and was a member of the Nominating & Governance Committee and the Compensation Committee. She formerly served on the boards of both Fibrocell Science, Inc. (“Fibrocell”), a company that specialized in the development of personalized biologics and Polymer Group, Inc. (“Polymer”), a global manufacturer of engineered materials. Fibrocell was a NASDAQ listed company and Polymer was a Blackstone portfolio company with publicly traded debt. For both Fibrocell and Polymer, Ms. St.Clare served as the Audit Committee Chair until their respective sales to strategic buyers. Ms. St.Clare holds a Bachelor of Science in Accounting from California State University at Long Beach and has been a licensed Certified Public Accountant in California, Texas and Georgia. Ms. St.Clare’s background in accounting and support of publicly held companies, as well as her experience with biotechnology, makes her well suited for service on our Board. Rick Sterling. Mr. Sterling has served on the Board of AquaBounty since September 2013. He served as the Chief Financial Officer at Precigen Inc. (NASDAQ:PGEN) (“Precigen”) from 2007 through March 2021, including leading them through their initial public offering in 2013. During his term at Precigen, Mr. Sterling was responsible for multiple private and public equity and debt capital raises, financial diligence for and integration of over a dozen acquisitions, SEC reporting and compliance, divestitures of businesses, budgeting, and negotiations of facility leases as well as oversight of human resource and information technology functions. Prior to joining Precigen, he was with KPMG where he worked in the audit practice for over 17 years, with a client base primarily in the healthcare, technology and manufacturing industries. He has a Bachelor of Science in Accounting from Virginia Tech and is a licensed Certified Public Accountant. Mr. Sterling’s background in audit and finance, as well as his experience with technology companies, make him well suited for service on our Board. Michael Stern. Dr. Stern joined the Board of AquaBounty in May 2022 and is the former CEO of The Climate Corporation and Digital Farming for Bayer Crop Science (“Bayer”) and a member of the Crop Sciences Executive Team. Before joining Bayer, Dr. Stern had a 30-year career at Monsanto Company (NYSE:MON) (“Monsanto”), where he was a member of Monsanto’s Executive Team and led their Row Crop Business in the Americas. In addition, Dr. Stern served in a variety of leadership roles at Monsanto, including Vice President of U.S. Seeds and Traits, President of American Seeds, CEO of Renessen LLC, a biotechnology joint venture with Cargill, and Director of Technology for Agricultural Productivity. Dr. Stern is a member of the Board of Directors of Lavoro Limited. Dr. Stern also serves as Chairman of the Board of Trustees for the Missouri Botanical Garden and served on the board of the Monsanto Fund and the board of Clara Foods, a San Francisco based company focused on developing novel animal proteins from cell culture. Dr. Stern received a Ph.D. in Chemistry from Princeton University, a Master of Science in Chemistry from the University of Michigan and a Bachelor of Science degree from Denison University. Dr. Stern’s brings broad experience in the food industry and biotechnology to our Board. Sylvia Wulf. Ms. Wulf was appointed Executive Director, President, and Chief Executive Officer of AquaBounty in January 2019. In 2023, Ms. Wulf was elected Chair of the Board of AquaBounty, and she relinquished her position as President, as part of the Company’s leadership progression process. Prior to joining AquaBounty, Ms. Wulf served as a Senior Vice President of US Foods, Inc. (NYSE:USFD), where she had been President of the Manufacturing Division since June 2011. Prior to US Foods, Ms. Wulf held senior positions in Tyson Foods, Inc. (NYSE:TSN), Sara Lee Corporation, and Bunge Corp (NYSE:BG). She is also currently on the Board of Directors and the Executive Committee of both the National Fisheries Institute and the Biotechnology Industry Organization. Ms. Wulf received a Bachelor of Science in Finance from Western Illinois University and a Master of Business Administration from DePaul University. Ms. Wulf provides extensive experience in the food industry in North America, including its fish sector to our Board. Our Executive Officers The following table identifies our executive officers who are not members of our Board and sets forth their current positions with us. | | | | Name | Age | Officer Since | Position(s) | David F. Melbourne | 57 | 2022 | President | David A. Frank | 63 | 2007 | Chief Financial Officer and Treasurer | Angela M. Olsen | 55 | 2019 | General Counsel and Corporate Secretary |